In the decade leading up to 2018, global financial institutions were fined almost $27 billion for Anti-Money Laundering (AML)/ sanctions non-compliance. With an average fine of $195 million, U.S. regulators led the way by levying 91 percent of these fines on both institutions and individuals.

In response to this wave of sizeable fines, financial institutions have infused billions of dollars into technology and personnel to fortify their AML infrastructure. Following the 2012 money laundering scandal, multinational investment bank and financial services company HSBC invested $290 million to overhaul its surveillance systems and hired thousands of employees to monitor any potential money laundering activity.

The key to avoiding these fines is a robust AML/ Know Your Customer (KYC) program. As detection and prevention of financial crimes is increasingly scrutinized by regulators worldwide, institutions with effective KYC programs are successfully minimizing their risk of being used by criminal operators for money laundering activities.

A well-performing AML model forms the backbone of a bank’s AML/ KYC program. At its core is a suspicious activity monitoring process which reviews and analyzes transactions performed by a bank’s customers.

Nonetheless, a model can only be as effective as the data collected. In an age when banks process tens of thousands of transactions, detection of suspicious activity is akin to spotting a needle in a haystack. This level of complexity brings the spotlight on data management and ETL (extract, transform and load) systems.

We continue to identify opportunities for our clients to improve the quality, structure, and consistency of data feeds, and have noted a lack of comprehensive documentation that can impact the performance of an AML model. These trends in data management practices have plagued some of the largest U.S. banks throughout the 21st century.

In December 2018, the Financial Industry Regulatory Authority (FINRA) levied a $10 million fine on Morgan Stanley, partially due to the bank’s failure of its AML surveillance system to receive critical data from several source systems. In addition, FINRA has observed problems with “data integrity in AML automated surveillance systems” at many financial institutions over the past decade.

An ever-increasing transaction volume coupled with the need to monitor ingenious money laundering schemes imply an exponential growth in the number of alerts generated. At most financial institutions, AML staff spend thousands of hours and millions of dollars investigating non-productive alerts. A high amount may lead to a scarcity of resources within the bank to handle each one. Failing to investigate suspicious activity could result in heavy fines similar to those mentioned above.

Ultimately, being able to identify valid alerts can vastly improve efficiency of an AML model, which is where the process of model tuning can serve an important function.

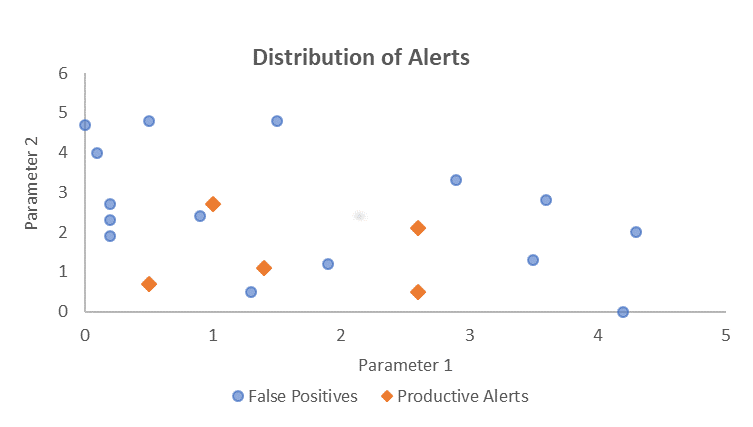

The role of model tuning is to increase efficiency by filtering out non-productive alerts without impacting those that are productive. In the simple illustration below, the ratio of productive to total alerts is 25 percent. Setting the thresholds of parameter 1 and parameter 2 at less than or equal to 3 increases this ratio to 45 percent without an impact to the number of productive alerts. An effective tuning process can reduce the number of false positives with minimal impact on the number of productive alerts, thereby allowing the bank to efficiently allocate its resources.

The advent of advanced analytics, combined with traditional techniques such as above-the-line and below-the-line testing, facilitate development of more efficient TM models. From traditional tools such as Microsoft Excel and SQL for simple rule-based models, to machine learning algorithms developed using Python for more complex models, there are numerous methods for effectively tuning model parameters.

While analytics defines the quantitative aspect of model tuning, the qualitative aspect cannot be ignored. It is essential to include the business and industry acumen of teams manually reviewing alerts at each step of the tuning process.

Attention to data quality and employment of appropriate analytical methods can help financial institutions avoid regulatory fines. Tuning, however, is not the end of the line in the development lifecycle of an AML model. In this blog series, we will explore mechanisms to monitor and maintain AML models to ensure optimal functionality.