The drive to streamline business processes for maximum efficiency and scalability leads global enterprises to chase down optimization at every opportunity. This desire commonly results in the adoption of:

- Cloud-based unified data architectures.

- Agile operating models.

- Cross-functional Centers of Excellence (CoE).

These frameworks lay the foundation for intelligent automation technologies like machine learning (ML), artificial intelligence (AI), and robotic process automation (RPA).

Missing the window of time to optimize is make or break.

Forrester predicts 5% of Fortune 500 firms will integrate automation fabric to “fuel extreme innovation.” Going further, “Companies with advanced automation programs obliterate – not merely beat – the competition.”

With the Office of the CFO (OCFO) sitting at the nexus of digital transformation, financials, and business strategy, it must lead the charge of finance process optimization backed by automation.

What Is Finance Process Optimization?

Finance process optimization is the practice of transforming internal and external finance tasks and responsibilities for greater time, cost, and resource savings. Ad hoc point solutions may specialize in the optimization of narrow, individual finance and accounting processes, but full-scale finance process optimization is more concerned with the end-to-end framework for fundamentally transforming how the finance function operates.

Because the finance function touches virtually every other business unit, the optimizations made by the finance team can be extended into subsequent functions, like HR, IT, and procurement.

In this way, finance process optimization is really a staging environment for adjacent digital transformations that cross lines of business and operational silos.

On a basic level, optimizing the processes within finance commonly includes:

- Establishing clear divisions of labor inside and between functions.

- Instituting change management and project management protocols that enable workflows to be repeatable and scalable without bottlenecks.

- Addressing gaps in stakeholder expectations and internal controls.

- Improving reporting, cycle times, and other back-office requirements.

- Implementing technology solutions that reduce redundancies, inefficiencies, and technical IT debt.

This final point – using digital technologies for maximum impact – is, in the modern finance function, a chief duty and mandate of the CFO. Organizational change to structure and staff can accomplish only so much efficiency.

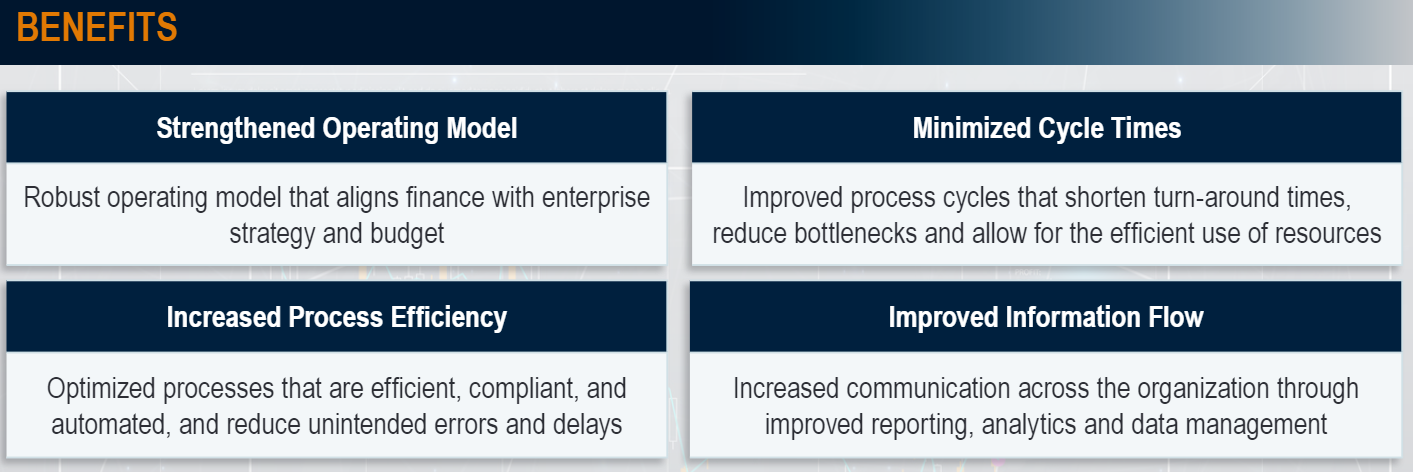

Enterprises must segue into the true, value-add phase of finance process optimization: automation platforms that resoundingly transform what finance operations are capable of and drive competitive advantage in the marketplace.

Finance and Accounting Processes to Automate

The finance department can benchmark current process performance against future process improvement throughout an automation initiative.

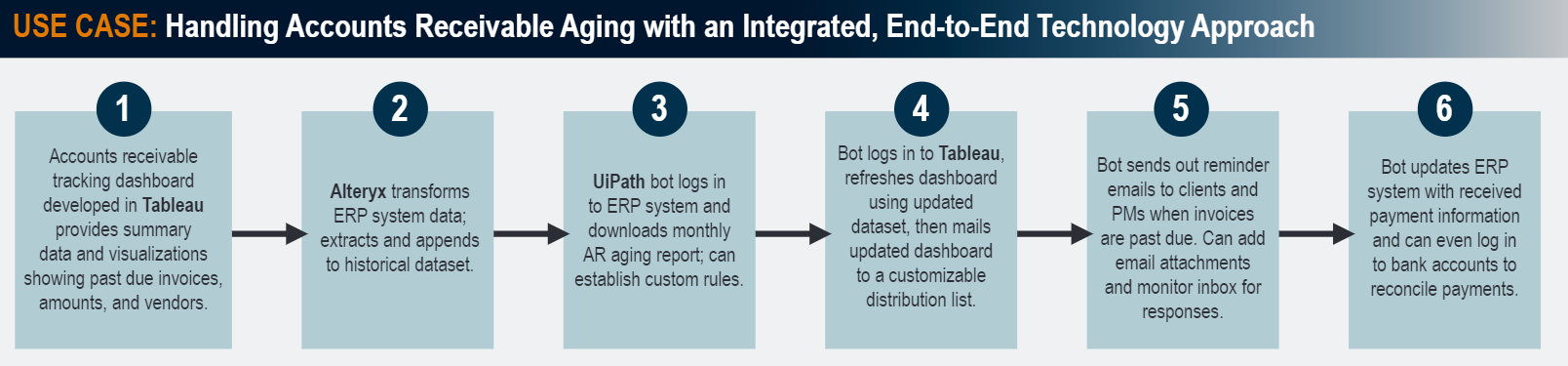

As batches of rote finance and accounting processes migrate to an automation tool, like UiPath or Alteryx, management can continuously iterate the future of the finance function. More bots mean less overhead and more time for strategic work and value creation.

Organizations typically focus initial forays into robotics software on:

- Invoicing and spend optimization.

- Financial close processing.

- Compliance and governance.

- Inventory and logistics management.

- Profit & Loss (P&L) and other forms of financial reporting.

- Revenue assurance.

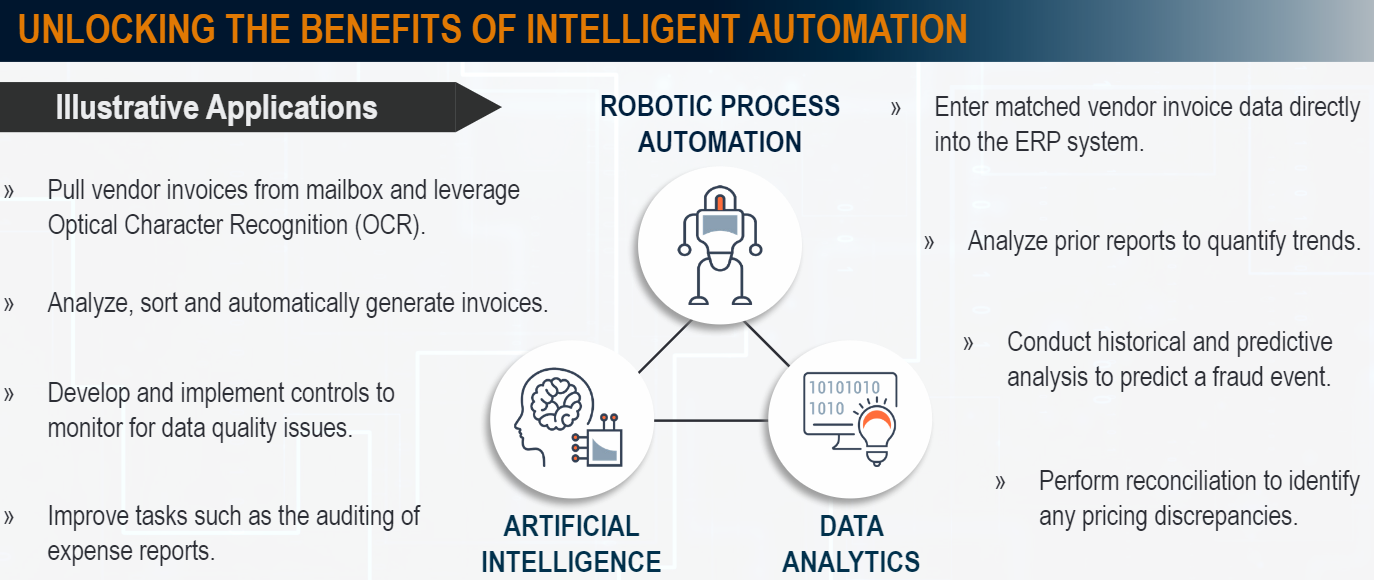

As RPA bots ingest data and perform key finance tasks once completed by staff, ML and AI algorithms can analyze and learn from these actions and deliver automated strategic insight. The collaboration of RPA, ML, and AI in a cohesive framework – known as intelligent automation – brings speed, intelligence, and decision-making right into the hands of key stakeholders.

This capability then enables finance leaders to conduct faster and more accurate financial planning & analysis (FP&A) by allowing them to interpret and act on data rather than create it and manage it.

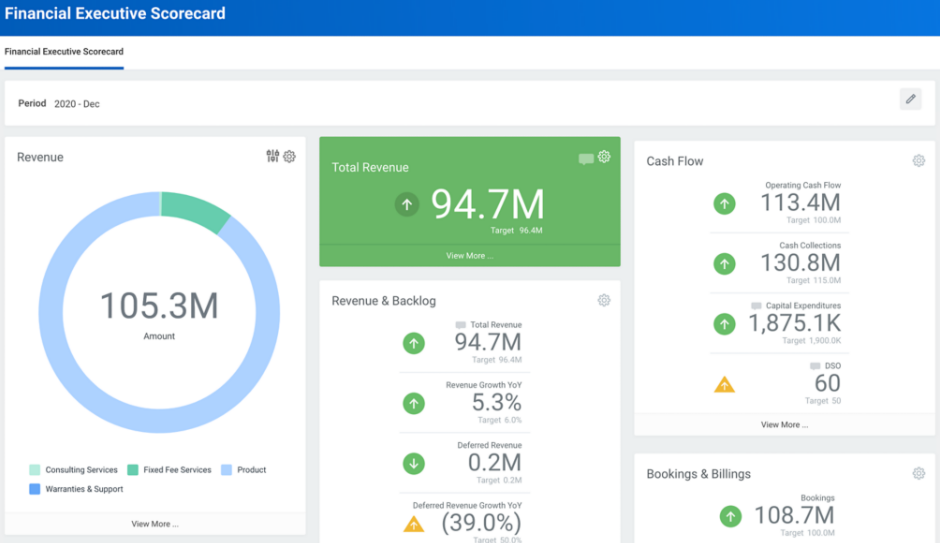

(Source)

As seen in the image above, finance data can be operationalized in dashboards for enhanced visibility and decision-making. Forecasting, cash flow, and other key financial metrics are inherently thus optimized for greater utility.

So while finance process optimization is centralized on processes, the outputs – savings, visibility, insights, etc. – are also optimized in firms that deploy intelligent automation.

Organizational Process Automation: Continuous Optimization

Business process automation is by no means confined to finance processes. Therein lies an incredibly powerful outcome of the CFO spearheading automation initiatives: success earned in finance can be leveraged throughout the rest of the business sequentially or adjacently.

Referred to as hypergrowth automation, this methodology is essentially promoting an “all systems go” automation mentality throughout the entire value chain of the business. Anything and everything that can be automated in any department is fair game.

In practice, what this is means is that the organization as a whole is “always on” to optimization: it’s a continuous, automated movement. Continuously optimizing processes, duties, integrations, vendor relations, inter-departmental connections, and employee skillsets foster an environment in which change is expected, encouraged, and executed.

It’s transformation at scale.

Implementing automation in the pursuit of continuous optimization can support:

- Global policy enforcement.

- Internal controls standardization.

- Faster speed to decision.

- Agility to future business transformation.

- Focused, aligned business goals across teams.

- Enhanced workforce competence through upskilling.

- Sunsetting outdated, siloed legacy systems and software.

- Unified operating models and data architectures.

What started as a finance initiative, as you can see, steadily snowballs into firmwide transformation.

Processes operate more smoothly, people work more strategically, and the business as a whole adapts in near real time: a self-sustainable machine propelled by automation.

For expert support in your finance transformation journey, contact CrossCountry Consulting today.