The effective date for the Current Expected Credit Losses (CECL) accounting change is fast approaching for non-public entities.

Securities and Exchange Commission (SEC) filer public business entities have already implemented CECL and now all credit unions, small reporting companies, and non-SEC filers must comply with the CECL guidance to ensure the standard is in effect for annual financial reporting periods beginning after December 15, 2022 (i.e. 2023 for calendar year-end companies).

CECL significantly changes how entities account for credit losses for financial assets and other instruments not measured at fair value through net income. Under this model, entities are required to estimate the expected lifetime credit losses on financial assets ranging from short-term trade accounts receivable to long-term financings. This will require changes and enhancements to accounting policies, internal processes and controls, and financial statement disclosures.

All entities with balances due or that have off-balance sheet exposure are impacted. The types of Financial Assets within the scope of CECL are as follows:

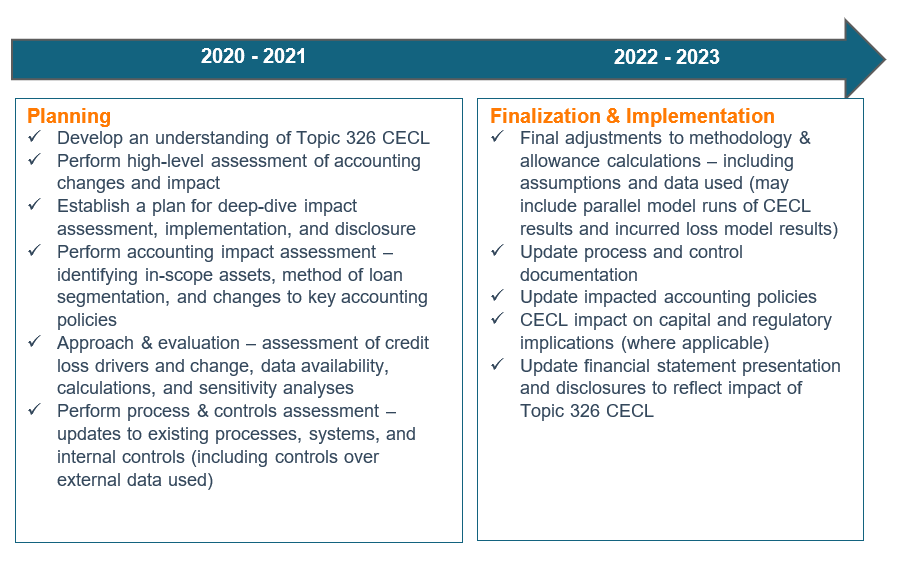

As the effective date of transition approaches, most entities are likely to be at the finalization and implementation phase of this process:

Lessons Learned From First Adopters

While challenges vary depending on the organization, some of the most impactful lessons learned from first adopters include:

Data Sourcing for CECL Is not Limited to Historical Information

The CECL standard focuses on estimation of expected losses over the life of in-scope financial assets, while the current standard relies on incurred losses. Although historical loss data can be useful in estimating the expected loss allowance, this is not sufficient to meet requirements.

The areas to consider in concluding that your expected credit loss estimates are reasonable and supportable are:

- More data is required, both historical and forward-looking. Data sourcing and individual asset treatment have been cited as some of the most significant challenges of CECL implementation, as inaccurate/insufficient historical and forecast data will result in inaccurate expected credit loss results, presentation, and disclosure information.

- The CECL standard allows entities to use judgment when determining relevant information and estimation methods appropriate for their specific circumstances. Where internal historical loss data is not sufficient, it’s possible to supplement this with external or peer data as appropriate. The limitations of internal data must be documented, as well as the key characteristics and adequacy of external data sources used for model inputs.

- The impact of the Covid-19 pandemic has also contributed to this challenge, with historical and forecast data being heavily influenced by unprecedented levels of credit losses/delinquency, risk/interest rates, and overall uncertainty. Companies should therefore exercise flexibility and consider a wide range of scenarios in estimating their credit losses to cater to extreme volatility.

Ongoing CECL model evaluation post-implementation must also be incorporated into future planning. This includes documented procedures for tracking changes and assumptions. Entities should continue to refine future estimates of expected credit losses based on changes in scenarios and actual experience.

Financial Statement Disclosures Can Be Challenging

With highly complex inputs and analyses, it can be challenging for companies to determine the appropriate level of detail to include in their financial statement disclosures; however, it’s imperative that management disclose key inputs and fundamental changes to estimates going forward. Small changes in underlying assumptions and inputs may result in big impacts to output results, and this should be communicated to stakeholders.

There is no “one-size-fits-all” approach to CECL disclosures, and the challenge is that the standard is based more on principles as opposed to a “to-do” checklist. Too little disclosure information can be just as confusing as too much information for the users, so companies must strike an appropriate balance by being both thorough and concise when drafting CECL disclosures.

One of the challenges faced by first adopters was that disclosures did not provide sufficient detail on key assumptions used in their allowance for credit losses or fundamental changes post-implementation. As such, the next wave of CECL adopters should pay particular attention to this area.

Due to the principles-based nature of CECL, comparison between companies can be challenging based on different CECL model inputs and outcomes. It’s therefore important for management to understand the assumptions and conclusions and to highlight information that enables the company’s stakeholders to understand:

- The credit risk inherent in a portfolio and how management monitors the credit quality of the portfolio. This includes an understanding of how management monitors the credit quality of its financial assets as well as the arising quantitative and qualitative risks.

- Management’s estimate of expected credit losses. This includes management’s method for developing the allowance for credit losses, information used by management in developing the current estimate of expected credit losses.

- Changes in the estimate of expected credit losses that have taken place during the period. This includes an explanation of the circumstances that caused changes to the allowance.

Organizational and Operational Changes Cannot Be Ignored

- Collaboration between Finance and Risk teams.

- Traditionally, Finance and Risk groups have operated independently from one another, with limited opportunities for interaction. Now, alignment between these functions is an integral part of CECL implementation. While the Risk function is tasked with building and validating models/calculations to estimate credit losses, Finance is tasked with the presentation and disclosure of provisions. This will require a greater level of coordination between these groups in achieving complementary goals: the effective management of credit risk and the accurate presentation and disclosure of CECL adoption in the Financial Statements.

- Changes to system capabilities to accommodate extraction, compilation, and retention of key data.

- A higher level of automation and integration of systems may be required both pre- and post-implementation to ensure high levels of accuracy and integrity of data for expected credit loss allowance analysis and validation.

- Changes to processes, functions, and internal controls.

- CECL implementation will require changes to processes and functions performed across multiple teams within the organization. This will most likely result in greater automation as well as additional and more stringent control measures and testing across impacted processes to ensure ongoing compliance.

- Costs of implementation and compliance (investment in new/additional systems, staffing, training, etc.).

- Engaging a third-party vendor to assist with CECL implementation (including model risk management, project management, accounting, and using current resources more efficiently), may prove to be a more cost-effective and efficient approach as opposed to building an in-house team.

With the deadline for CECL fast approaching, credit unions and non-PBEs must be ready.

Consider these lessons learned from early adopters as you continue to assess the impact of this new accounting standard on your business.

With our deep expertise in helping public and private companies implement emerging and ongoing accounting standards, analyzing and documenting complex transactions, and assessing necessary changes to financial reporting and operational processes, our professionals work alongside our clients and their auditors to anticipate and respond to these accounting challenges.

For expert support in implementing CECL, contact CrossCountry Consulting today.